14+ fico mortgage

Web The FICO Score versions used in mortgage lending and the more recently released versions such as FICO Score 9 and 10 have the same 300 to 850 range. For homeowners looking to.

Mayra Barajas Santa Clarita Ca

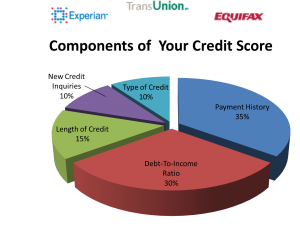

Web The FICO credit scoring model looks at five key factors and weighs each differently.

. Financial institutions use FICO Scores to make consumer credit decisions. Web Its possible to get approved for a mortgage loan with a credit score in the upper 500s to low 600sor lower in some casesbut your best bet for a low interest rate is to have a score in the mid-to-upper 700s. Web FICO scores used for mortgage - and where to obtain them The FICO scores used for mortgages Equifax Beacon 50 ExperianFair Isaac Risk Model V2SM TransUnion FICO Risk Score Classic 04 These are sometimes listed on the tri-merge mortgage report as follows.

If your score changes to 640. Web If you were to go to the closing table with a 20 down payment and opted for a 30-year fixed-rate mortgage heres how much it would cost you over time depending on your interest rates. Scores range from 300 to 850 with scores in the 670 to 739 range considered to be good credit scores.

VantageScore a competing maker of credit scores also uses that range for its latest VantageScore 30 and 40 model credit scores. Your FICO score helps the lender determine how likely you are to be a credit-worthy borrower. The APR on a 15-year fixed is 624.

If your credit score needs some work check for the following issues on your reports. Web After a historical rate plunge in August 2021 mortgage rates skyrocketed in the first half of 2022. Web The complete pricing solution for your mortgage originations and renewals business.

Web According to FICO the current interest rate for a 30-year fixed mortgage is 2377 APR for a 760 borrower and 3966 for a borrower with a score between 620 and 639 which is considered. If you start with a credit score of 620-639 heres how much youd save over the course of your mortgage by boosting your credit score. VantageScore a competing maker of credit scores also uses that range for its latest VantageScore 30 and 40 model credit scores.

Web FICO scores are used in 90 of mortgage application decisions in the United States. Todays mortgage interest rates are well below the highest annual average rate recorded by Freddie Mac 1663 in 1981. Web FICO brings the analytic expertise and next-generation decision management technology that lenders need to modernize every part of the mortgage lending process from prequalification to pricing to underwriting and put them.

FICO stands for Fair Isaac Corporation a consumer credit analytics firm that. Web The primary expectation for Home Affordable Refinance is that refinancing will put responsible borrowers in a better position by reducing their monthly principal and interest payments reducing their interest rate reducing the amortization period or moving them from a more risky loan structure such as an interest-only mortgage or a short. Web The FICO Score versions used in mortgage lending and the more recently released versions such as FICO Score 9 and 10 have the same 300 to 850 range.

In this example boosting your credit before you get a mortgage could save you 284 per month 3408 per year and 102183 over the life of your loan. Web For today Thursday March 16 2023 the current average interest rate for a 30-year fixed mortgage is 697 falling 16 basis points compared to this time last week. It was 628 a week earlier.

Web Todays rate is higher than the 52-week low of 380. Web Posts about Loan Programs written by Bud Bruening - Mortgage Solutions Team. Web Since its introduction over 25 years ago FICO Scores have become a global standard for measuring credit risk in the banking mortgage credit card auto and retail industries.

Web How mortgage rates have changed over time. 90 of the top 100 largest US. For conventional borrowers with 3-5 down and a credit score in the low 600s PMI rates can be relatively high.

Seamlessly deploy optimized pricing strategies to your frontline resources increasing the effectiveness of your sales force by empowering them to. Web Mortgage lenders use several tools to assess credit risk for potential borrowers including your income-to-debt ratios employment stability and your credit history. Whether youve paid past credit accounts on time Amounts owed 30.

Web Research has indicated that FICO Scores are more predictive when they treat loans that commonly involve rate-shopping such as mortgage auto and student loans in a different way. Web This frees up funds so that banks can offer new mortgages to additional homebuyers. Indeed the 30-year averages mid-June peak of 638 was almost 35 percentage points above its.

Web However the two models differ in a few ways with one major difference. For these types of loans FICO Scores ignore inquiries made in. Leverage prescriptive analytics to discover optimal prices that best align to your current volume and margin goals.

Some of these guidelines require borrowers to have a minimum credit score under specific FICO Score generations. A 15-year fixed-rate mortgage with todays interest rate of 621 will. Web The cost of PMI is based on your down payment and credit score.

Web Mortgage Rates Forecast Through March 2023 Experts are forecasting that the 30-year fixed-mortgage rate will stay within the 5 to 6 range in later 2023 though some predict it might go. FICO and VantageScore also differ in how they handle combining similar credit inquiries. For a bank to sell a mortgage to Fannie Mae or Freddie Mac the loan has to meet certain guidelines.

July 19 2011 1012 PM Big firms say new wave of REO business on horizon. EquifaxFICO classic V5 FACTA ExperianFair Isaac Ver. FICO penalizes all late payments the same way while VantageScore penalizes late mortgage payments higher than other late payments.

Web If you compare the highest and lowest credit score tiers the borrower with better credit saves about 390 per month and 140000 in total interest over the life of their mortgage loan.

![]()

Loan Officers Do You Get Annoyed By People With Poor Credit R Credit

Mortgage Basics Part 1

Mortgage Basics Part 1

Why The Bureaus Of Equifax And Transunion Don T Update My Credit Score Despite 6 Days After Paying A Huge Amount Of Money I Have Paid About 1200 Instead Of Paying Minimum Payments

:max_bytes(150000):strip_icc()/Courtney-Keating-E-Getty-Images-56a0d4195f9b58eba4b43283.jpg)

Fico 5 Vs Fico 8 What Are The Differences

Promise Roland Johnson Realtor Fort Worth Tx

Bildergalerie Von T E

Do Student Loans Have An Effect On Your Credit Score Does Its Impact Go Down After So Many Years Quora

March 2018 Digital Finance Analytics Dfa Blog

4 Credit Services

Back To Basics Mortgage Lending 101

Bank Statement Loans North Palm Beach Fl Self Employed Borrowers

:max_bytes(150000):strip_icc()/GettyImages-589581678-23ccd13ee2714e569cf51d6fa754ec12.jpg)

Personal Loans Vs Car Loans What S The Difference

Blake Maggio Gmfs Mortgage Prairieville Louisiana

Can Deferred Student Loans Hurt My Credit Score Quora

G400311mmi002 Gif

Adam Hires Owner Coach Hires Coaching Llc Linkedin